Remit Consulting’s recent active travel forum, hosted at FORE partnership in London, explored the intersection of active travel and real estate. Guest speaker Will Norman, London’s Walking and Cycling Commissioner, identified how and where there is room for positive change and, more importantly, why should we care as property folk.

It’s a matter of life or death.

Think about this - air pollution in major cities across the country is endangering public health and threatening the NHS’s survival. Meanwhile, in London, it is estimated that the capital’s congested roads force drivers to spend 150 hours in traffic annually.

Is it any wonder that there are calls for increased active transportation?

The problems might be different outside London, but they are no less significant. Despite the inactivity of people putting significant pressure on health services, it appears that there are fewer active travel initiatives being adopted by local authorities and developers, and more importantly embraced by the public.

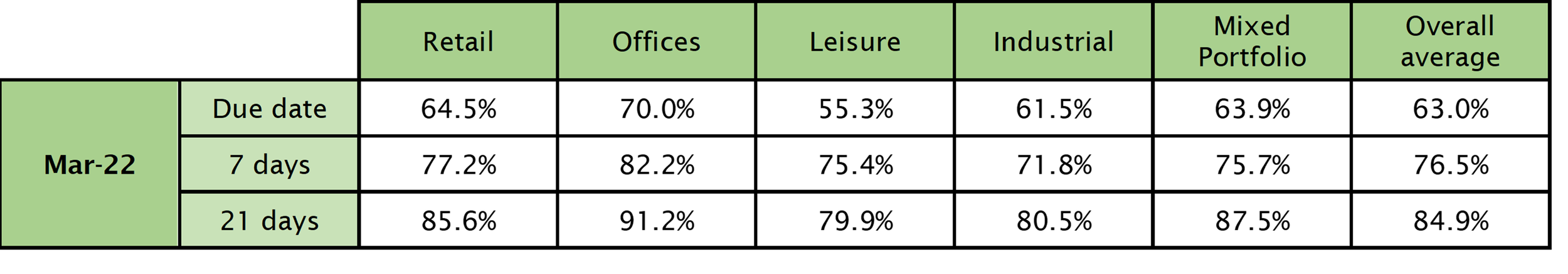

Financial incentives can’t be ignored

Although getting people out of cars and onto bikes or walking is a huge benefit in itself, active travel is more than just about health issues. Studies have shown that improving walking, cycling and public realm provisions on high streets can increase retail sales by 30%, through increases in potential customers ‘popping in’ to local shops. With turnover increasingly playing a role in lease negotiations, surely this is a statistic the real estate industry should be taking note of.

This is before you consider that rental values can increase by ~7.5% in safer and cleaner areas.

What is not safe and not clean? How about an overload of van deliveries and no pedestrian walking zones?

Lifestyle choices are driving the change

The trend of urban living is moving in favour of people wanting a ‘liveable’ lifestyle, where the commute is easy, kids can have some green space to play and going for a run doesn’t mean waiting at zebra crossings for half the time, and dodging cars the rest.

The image above is the same road as the previous image, after an initiative to pedestrianise.

Collaboration is key

The reasons to invest in active travel are endless, and each one is just as valid as the last, however positive change is reliant on partnerships between thought leaders, local authorities and investors. You lose one and it seems you have none.

But what is the good news? Real estate connects these three pillars of change. Landlords can apply pressure on local authorities to take active travel initiatives seriously. Developers and investors can fund the positive change. The network of learnt experience from what has already been achieved in developments can push thought leadership, both in London and further afield.

From this first recent active travel forum alone, Will Norman went away to work on creating a central framework for planning regulations, to fight the issue of each borough having its own, different tick boxes to fill out.

So, the task is not simple but, in the long run, with greater connectivity between the three pillars of change, cities could see themselves becoming a lot cleaner, safer, healthier and more valuable too.

To find out more about Remit Consulting’s Active Travel initiatives, take a look at the forum page and also ReTour.