Key takeaways from Expo Real in Munich:

• Tech dominates innovation, and you can see those who are using data effectively

• New business models for funds and REITs are shaking up the market

• Despite market and economic uncertainty, most real estate businesses are planning for growth

Expo Real revealed the growing gap between those who “get” technology and those who would prefer to refine their traditional approach. There is a risk that established property players will lose their market to those using technology to change the game.

Expo Real 2022

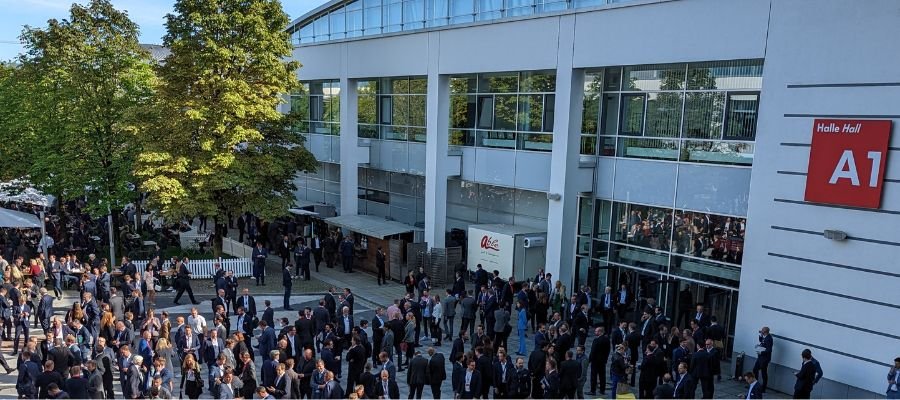

The beginning of October saw the full return of Expo Real in Munich, following two years that made it necessary for the annual event to become ‘virtual’ in 2020 and ‘hybrid’ in 2021.

Maybe the return of the globally famous Oktoberfest helped boost the confidence of people to return, but reports suggest that the 2022 event was as big as it ever was before the pandemic, with seven of the vast halls of the Messe München conference centre, totalling 72,250 sq m (777,700 sq ft), full of stands occupied by 1,887 exhibitors from the real estate sector, from across Europe and beyond. The official news release from the organisers says that there were almost 40,000 attendees at the event. Anyway, the traditional client event at the Oktoberfeste in the Marstall tent hosted by Remit Consulting on the last evening of these festivities was a great success, with clients attending in ‘Trachten’ from both the UK and the Netherlands.

It certainly felt that things were back to normal.

Then again, at the same time, it didn’t.

Things have changed since the 2019 event. There was a more relaxed attitude at the conference; those wearing ties were in the minority, and an increase in technology exhibitors and visitors meant that business casual clothes and trainers were much in evidence, which is a welcome change for such a huge event. Our team’s step count ranged from 10,500 per day up to 30,000 steps in one case. It would seem that Germany is no longer as formal in its attire as it used to be.

Whilst the famous Savills “cubes” were once again used for informal meetings and open-air chats in the site’s courtyard, the equally well-used deck chairs in the landscaped sun-trap between halls were this year sponsored by shed specialist Panattoni. A sign, perhaps, of the importance that suppliers place on Expo Real.

As a business, we certainly found it to be valuable in terms of new business opportunities along with keeping up to date with market trends, innovation, and the changes that are transforming the market. Remit’s Dutch team focused on interviews concerning several projects, with Hans and Antoine each managing between eight and ten meetings a day.

The UK team found time to find new contacts around the halls and quiz established contacts about their updated services and technology. Unusually, it was reasonably easy to get meetings at short notice with key individuals – there appeared to be fewer booked meetings and a more freestyle approach.

Crisis what crisis?

Despite the obvious dark clouds on the horizon of the energy crisis and the strong possibility of a global recession, the famed optimism of the real estate industry meant that few in attendance were being anything other than positive. Whilst there was a quiet acceptance that tough times may lie ahead, many at the conference were looking at how to adjust to the reality that Europe is facing. For many, spiralling costs and the uncertainty caused by the war in Ukraine seemed to have been factored in as part of the normality of the situation.

Certainly, the domestic political situation in the UK seemed to be of no interest to those focused on the wider European market. One major developer summed up the attitude of the European property investment market to the relevance of current British political news, saying “I think we have enough to worry about without having to dwell on who your prime minister might be!”

The focus of Expo Real was not so much on the politics but on how to rise to the challenges faced by the industry and society as a whole, particularly on energy and ways to save it, and it was good to see several ESG-focused service providers, who have expanded quickly across Europe, collecting and analysing large amounts of useful information to feedback into energy savings.

Seminars and discussions

The focus on the energy crisis and spiralling costs, particularly associated with the residential sector, were certainly a major talking point in a panel session regarding the Polish Residential Market, and its appeal to international investors, which was moderated by Paddy and attended by over 100 delegates. From zoning and planning to the market’s reaction to the influx of displaced Ukrainian families, it was the EU Taxonomy Regulations and ESG disclosure requirements and the spiralling costs of construction which were the topics of most concern. As one investor highlighted “While the fundamentals of the market are attractive, we just can’t predict what the market will do over the next few months, so will just sit on our money and wait for now.”

The tantalisingly titled “Lessons learned from hundreds of Taxonomy Assessments and link to ESG with Blue Auditor” was just one of the many tech talks, though, which hinted that ESG in another guise has been around for some time and we should look to existing measures before reinventing the wheel.

“The Fate of International Investment Amid the Turmoil of Today” was a lively and thought-provoking panel session with senior representatives of M&G Real Estate, Savills IM, Allianz Real Estate, and MSCI debating the ‘denominator’ effect and the pros of looking further afield for the choice investment opportunities. A key prediction from the panel was that affordable housing was to be the new hot potato, or kartoffel, should we say.

Residential is a sector which is gaining more attention, partly due to the upheaval in retail and offices and the associated capital that needs to be reinvested. Many of the PropTech firms in Tech Alley had solutions aimed at the residential sector and believe that their immediate successes will be in that particular market.

Data and tech

In terms of technology on show at the conference, there was very little that was truly new. Many of the technologies on display were already being discussed in 2000. However, there are strong hints that the big investment money is focused on harvesting and analysing data to a far greater extent than in the past. Blackstone’s investment in tech companies was mentioned at almost every turn, and the big fund managers and REITs in the US seem to have stolen a march on the European funds in identifying the data they want to capture. What is certain is that as soon as the data content is secured, the costs to access that data will soar – and those controlling the data are likely to be from outside the industry.

The UK team spent some time attending a tour of Tech Alley which consisted of a series of two-minute intro presentations from PropTech companies, including:

Bots4you – a company who has an initial focus is on automating chat bots to support the letting of properties and thereby freeing up time and speeding the process

Joyce – provides a digital alternative to analogue processes for selling and renting apartments

Vilisto – Smart thermostatic radiator valves that detect room usage and controls heat based on demand saving up to 32% of heating energy and CO2 emissions

Priva – creating digital twins of a building’s energy systems to use weather and demand forecasts to predict energy use so that the optimum mix of energy input can be used to heat buildings more efficiently

BeeBoard – a project management tool (yes, really!)

Syte – An AI powered tool that researches and evaluates potential building sites reducing the time from weeks to seconds. It also analyses building sites and delivers their development potential in real-time by reference to real case studies and local regulations and policies

A key theme across the new technologies was the use of AI in many aspects of managing real estate, including faster site selection, energy use optimisation and customer service automation.

Unexpectedly, the software supplier MRI was not present at the show. Their place was filled by their rival Yardi, of course, and new pretenders in the PropTech space. There was more focus on asset and fund management tools than ever, answering clients’ questions on scenario planning and alike.

There is still a lack of real coherence to the systems market as the property investment market expands to new sectors and to gathering data from the “entire stack” from fund management to facilities and building management. No one system supplier seems to be able to tackle the whole property picture, leaving room for new data specialists like NTrust to make a good living gathering, cleaning, and inputting the additional data.

Looking forward to 2023

The two-year break from Expo Real seems to have rejuvenated the event. This might be because of the turmoil in the markets, or it might just be because of the appetite of delegates to meet in person again. Whatever the reason, it remains a key industry event and 4-6 October 2023 is already in the corporate diary.

Gallery