⦁ Verified figures reveal that, overall, 72.1% of rents were collected with seven days of due date

⦁ Significant uplift in rent collection for retail properties and from pubs, bars and restaurants

The collection of commercial property rents in the UK, seven days after the September quarter due date, have reached the highest level achieved for any quarter during the pandemic so far, according to the latest research from Remit Consulting in its regular REMark Report.

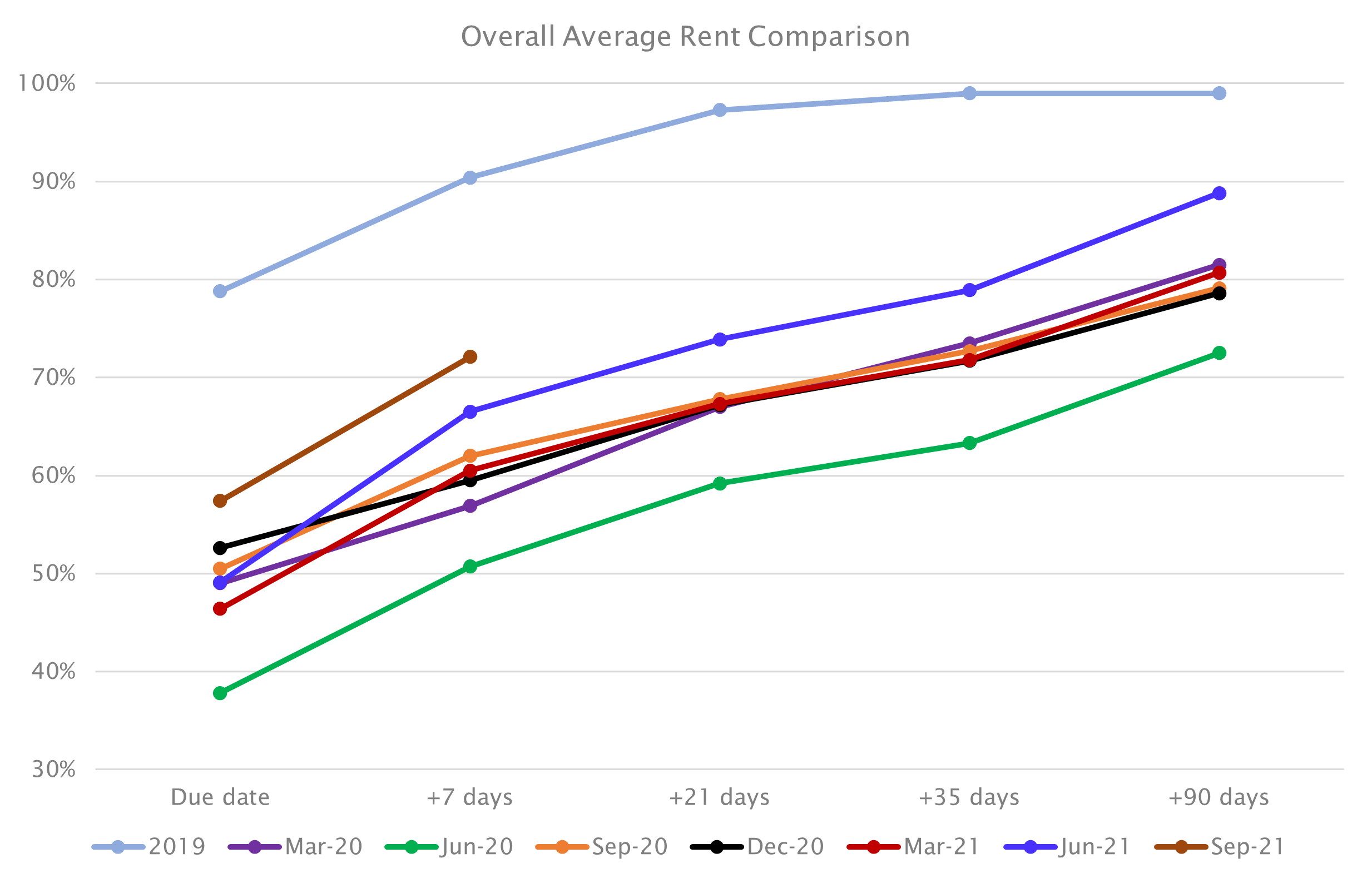

The figures for collection of rent and service charges, which are verified by the country's major property management agents, reveal that overall, an average of 72.1% of rents due from tenants of commercial property, were collected within seven days of the due date. This compares to a figure of 66.5%, collected at the same point in the previous quarter.

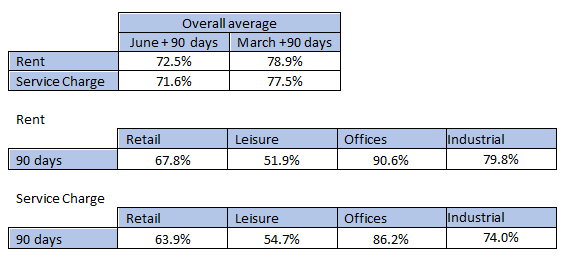

According to Remit Consulting, both the retail and leisure sectors showed significant improvements compared to previous quarters of the pandemic. Overall, 68.8% of retail rents were collected seven days after the September quarter day, compared to 62.3% at the same stage of the June quarter. Similarly, 57.2% of rents for leisure properties were collected, compared to just 40.1% in the June quarter.

The improvements were reflected by the sub-sectors, with 67.1% of high street retail rents having been collected and 46.8% of rents for pubs, bars and restaurants.

Steph Yates of Remit Consulting said: "The first seven days of the current quarter saw a rapid increase in the collection of rents and service charge payments, which is good news for investors and landlords such as pension funds and other institutions, particularly as the upward trajectory of payments from tenants is similar to the previous quarters of the pandemic. However, this quarter, the collection rates are on average, around six percentage points higher than the previous quarter, which was, in turn, the best three-month period of the pandemic so far.

"While the signs are promising, overall collection rates for both rents and service charge payments are still significantly lower than recorded by the REMark Report over the ten years prior to Covid-19."

According to the firm’s research, since the start of the pandemic in March 2020, investors and property owners, which include many pension funds and other institutions, have seen a shortfall in the rent they have received from commercial occupiers of almost £7 billion.

Remit Consulting has been analysing the collection of rent and service charge payments by the country's largest property management firms since March 2020, working in conjunction with the British Property Federation (BPF), the RICS, Revo, the Property Advisors Forum, and other members of the Property Industry Alliance (PIA). The research covers around 125,000 leases on 31,500 prime commercial property investment properties across the country.