Investors, fed up with the status quo, are willing to take risks on new business models.

The current model of property management is no longer fit for purpose and traditional property managers have five years to adapt if they are to remain relevant, according to the latest REMark report from Remit Consulting, the biennial study that benchmarks the performance of the property management sector in the UK.

Andrew Waller of Remit Consulting said, "Two years ago the REMark report highlighted the need for property managers to adapt their models to meet the expectations of their clients regarding the deluge of data being generated from buildings, tenants, and customers. We also suggested that, because they are the only party that has a complete overview, property managers should look to take control and administer all property data.

“Two years down the line a number of progressive businesses are addressing the issue, but they are the exception rather than the rule. Many property managers are still showing no sign of wanting to evolve and, with much of their role being automated, we estimate that property management businesses need to adapt quickly if they are still to be relevant by the middle of the next decade.

“The latest REMark report confirms that the frustration of landlords, and the continuing animosity between them and service providers, has not lessened. The report reveals that investors are increasingly frustrated by inefficient and out of date property management models.

“The availability of affordable technology solutions has given property owners the ability to structure the services that they need in a different way. This is exposing gaps in the traditional business models of most property management companies. As one commentator said earlier in the year, ‘The property manager simply gets in the way of digitising the company’.

“This might not be fair, but it reflects the mood of many investors who are increasingly looking at taking asset, property and facilities management in-house so that they can control all aspects of the customer experience,” he added.

According to the REMark report, the volume of data regarding occupiers has exposed failings of existing models, which are being addressed by new business models and entrants into the property management market. The report highlights that this summer, following its declaration that the traditional property management model was broken, Legal & General Investment Management announced a new property and facilities management structure. At the same time, several other Fund Management firms, struggling to define new ways of working within the confines of an asset management structure, which has not changed in generations, have started programmes to review the way they deal with property management in its broadest sense and kick started conversations amongst UK managing agents on where the sector is going.

The REMark report identifies various new models, some of which have developed outside the property industry while others have evolved through a need to change but where the property owner lacked funds to invest.

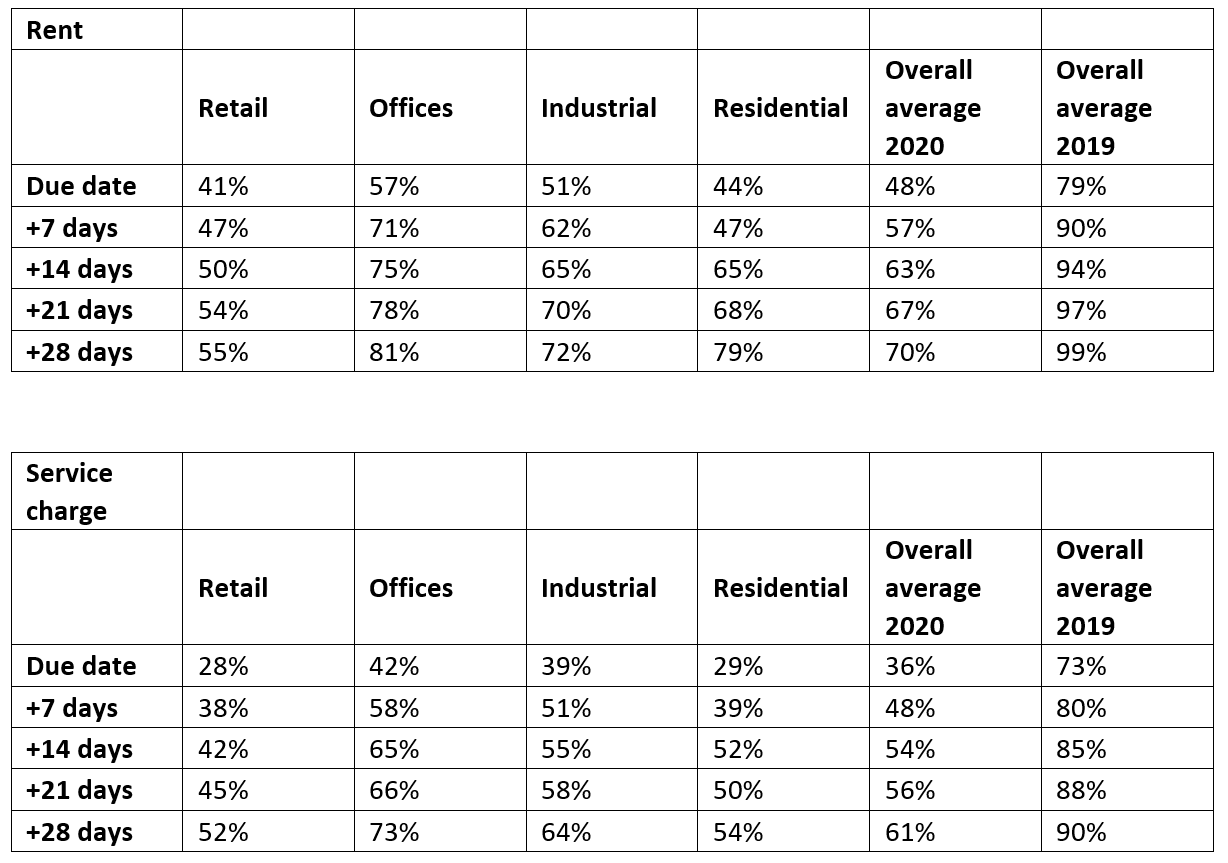

Rent Collection

Elsewhere in the REMark report, Remit looked again at how efficient the property management sector is at collecting rents on time, comparing performance against previous reports.

Compared to the last report in 2017, it seems as though there has been no further improvement and the industry still struggles to collect 80% of rents on the due date. The report considers why this is the case.

“One of our survey questions was regarding the use of direct debit as a method of rent collection,” said Steph Yates of Remit Consulting,

“It transpired that just 16% of residential rent is collected by direct debit and nearly 60% of the survey’s participants said that none of their residential rent was collected by this method.

“While direct debits hold clear advantages for landlords, at the moment there is no real incentive for tenants to sign up to pay rent by direct debit. There might be lessons to be learnt from the utility sector, which often offers money off bills in return for setting up and continuing direct debit payments. When it is considered that 56% of customers pay their energy bill by direct debit we have to ask whether the property sector could offer something similar in return for reduced costs?

Rent & Service Charge Performance

When it comes to the collection of Service Charges the REMark report highlights that while collection levels on the due date have increased since 2017, the overall collection has decreased with only 95% of service charges being collected within 120 days (compared to 99% in 2015). This can cause problems for landlords when it comes to funding the shortfall particularly in increasingly uncertain market conditions that may result in more disputes, a reduced ability of tenants to pay and longer collection periods.

“Since REMark 2017, the big change in service charges is that the RICS Code of Practice is now a Professional Statement, marking the change from guidance to mandatory obligations for all members,” said Steph Yates.

“However, the reconciliation period is not mandatory and the REMark report reveals that 23% of respondents said that it takes them over four months, with reconciliation periods of over of 30 weeks not unheard of.”

“This could be a result of a number of things, including the trend for tenants to question and fight service charges - which has come back with a vengeance, particularly among large retailers - meaning an increased number of weeks as more scrutiny is taken over the accounts before issue,” she added.

Customer service

Inspired by the likes of WeWork and new technology, even traditional landlords are realising the value that can be added to their portfolios by treating tenants as ‘customers’ and by providing them with premium services. They are increasingly looking beyond the basic customer service and are setting off in competitive pursuit of the elusive ‘customer experience’.

The result has been an increased focus upon ‘front of house’ activities: building managers, receptionists, security personnel, etc, and it is clear that standards have risen dramatically in recent years. Progressive property managers have improved training and often recruit from the hospitality and hotel sectors.

This year’s REMark report reveals that 62% of the respondents now employ a dedicated ‘customer service manager’.

This is an important step forward,” said Charles Woollam of Remit Consulting.

“However, it is curious that only three-quarters of them are in full-time roles. This may imply that some landlords believe that creating customer experiences, and promoting best practice customer service, is only a part-time role,” he adds.

To find out more or participate in REMark, please contact Steph Yates.