Only 72.5% of rent due to landlords on commercial properties was received over the June Quarter

Prospects for September Quarter “look bleak”

As quarterly rent demands begin to land on the desks of business occupiers, Remit Consulting reports that pension funds, institutions and other investors in the UK commercial property sector have experienced a further £1.5 billion shortfall in the collection of rent over the June Quarter. Remit’s research shows that, since the start of lockdown, over £3 billion in rental income has now been lost by property investors.

Working with the British Property Federation, RICS, PIA, Revo and other professional bodies, and based upon the analysis of 125,000 property leases, Remit Consulting has been studying the collection of rent and service charge payments by the UK’s biggest property management companies since the start of the Covid-19 lockdown in March.

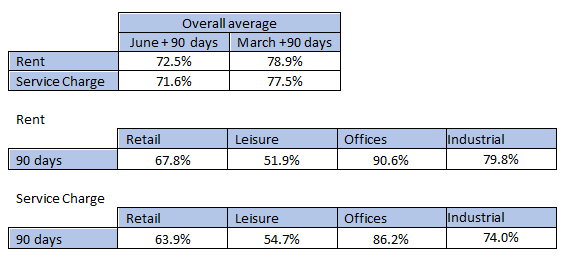

“Our analysis of the verified figures for the total rent collected 90-days after the June Quarter Day by property managers reveals that, overall, just 72.5% of payments due on commercial properties were received investors in the UK market. This is 6.4% lower compared to the previous quarter,” said Steph Yates, senior consultant at Remit Consulting.

“Based on data from the IPF, regarding the total value of UK property investments, this equates to a shortfall in excess of £1.5 billion over the last three-months. On the basis of our previous research for the March Quarter, this means that the income of pension funds and other investors now totals over £3 billion so far during the pandemic.

“With the moratorium on forfeiture for non-payment of rents by tenants of commercial properties still in place, local lockdowns and with people being encouraged to work at home, it is hard to see that this situation will improve by the end of the year. The prospects are looking bleak and if the Prime Minister's suggestion that the current restrictions could be in place for six months, it may well be much longer,” she added.

Melanie Leech, Chief Executive, British Property Federation said: “It is disappointing to see that the total shortfall in unpaid commercial rents has simply doubled over the past two quarters. While for many recovery is still at risk and more support will be vital, we continue to see well-capitalised businesses taking advantage of Government interventions and refusing to pay rent. All signals are pointing towards a total of £4.5bn in unpaid rents by the end of December, which is too high a mountain for businesses and property owners to climb on their own.”

UK rent and service charge collection data (March Quarter Day 2020 +90 days)

Note: The below figures are commercial averages only.