Collection rates still no better than at the start of the pandemic

Fears grow among investors, property and asset managers over tenants’ bad debts

and the threat of CVAs

The collection of the rent due on commercial properties in the UK is continuing to mirror those witnessed in the early stages of the pandemic, according to the latest research from Remit Consulting which projects a further shortfall for investors of around 20% at the end of the current Quarter.

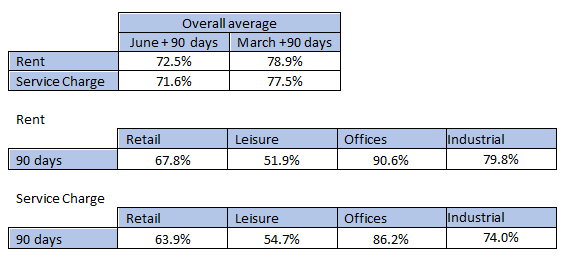

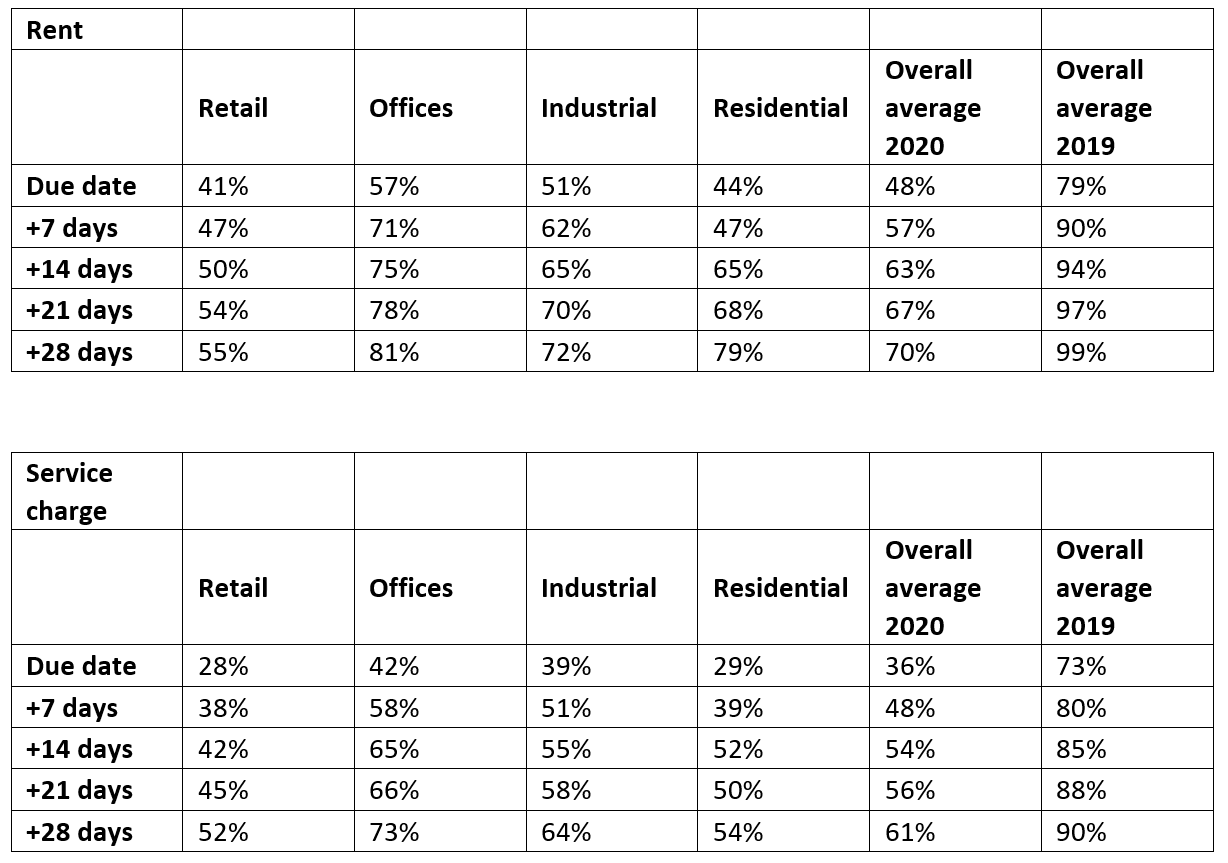

The study relates to the collection of rent and service charge payments by 3rd of November, 35-days after the September Quarter Day and two-days before the start of the second national lockdown. The firm’s analysis of rent and service charges collected shows that, five weeks after the September Quarter Day due date, 72.7% of the rent on commercial properties had been collected overall, along with 69.8% of service charge payments.

At the same stage in the March Quarter this year, 74% of rents had been collected and 63% of service charge payments had been received.

Steph Yates, senior consultant at Remit Consulting, said: "It is evident that the stricter restrictions and limitations that had been imposed by the Government in some parts of the UK earlier in the Quarter, and the expectation of a national lockdown had little impact on the ability or willingness of business occupiers to pay their rent.

“Seemingly, the propensity of tenants to pay what they owe is not influenced by the level of the restrictions placed upon the population. While the full impact of the second national lockdown on rent and service charge payments remains to be seen, landlords and property managers are concerned, particularly with regard to the retail and leisure sectors.

“The trajectory for the rest of this quarter indicates a further substantial shortfall of approximately £1.5 billion can be expected by landlords and investors by the end of next month. We have previously calculated that, over the first six months of the pandemic restrictions, the cost to pension funds, rates, institutions and other commercial property landlords was in excess of £3 billion. These shortfalls effectively become treated as bad debts, meaning that, by the end of the year, landlords could be facing a total deficit in rent alone of up to £4.5 billion.”

The shortfall in terms of the service charges owed by businesses on the properties they occupy is also outlined in Remit Consulting’s research. These costs cover building maintenance, insurance, security and cleaning, etc. The Government’s moratorium on pursuing unpaid rent through the courts during the pandemic does not cover the payment of service charges and the non-payment of these costs by tenants adds further pressure to landlord and tenant relationships.

“The extension of the Government’s moratorium on forfeiture for non-payment of rents by tenants of commercial properties in August eased the prospect of Company Voluntary Arrangements (CVAs) being exercised by business occupiers unable, or unwilling, to pay their debts. As the quarter progresses there are growing concerns with property managers, asset managers and investors that mass CVAs within the market could become a reality.

“In addition, there is a growing unease among investors concerning the impact that the drop in income could have on their ability to meet repayments on loans secured against properties. The impact of this could be disastrous for more highly leveraged businesses,” added Steph Yates.

Working in conjunction with the British Property Federation (BPF), the RICS, Revo, the Agent's Advisory Group, and other members of the Property Industry Alliance (PIA), Remit Consulting has been analysing the collection of rent and service charge payments by the country's largest property management firms since the start of lockdown. The research covers around 125,000 leases on over 31,000 prime commercial property investment properties across the country.