ESG Research: Mapping the Structure of ESG Software for Real Estate

REspond - ESG Software Research from Remit Consulting

In this article of our series on ESG software solutions, we explore the ESG software landscape for real estate companies, aiming to answer the question: How is the current ESG software market structured? By spotting trends and cross-referencing the real estate organisational pyramid with the results of the interviews created a framework that shows the capabilities of the different solutions.

What is ESG?

When discussing ESG software solutions, it is essential to define what ESG encompasses and clarify what we mean by ESG software. To guide our discussion, we will use the RICS definition of Environmental, Social, and Governance (ESG). A definition that refers to the three criteria for evaluating a company’s sustainability, ethical practices, and their impact on financial performance and operations. While also playing a role in assessing the impact of individual assets and operations [1].

When it comes to ESG software, its definition can vary widely. For this purpose, we will adopt a broader definition: software that helps organisations manage their ESG data. These solutions typically cover the entire data handling process—from collection and organisation to analysis—with different end goals, such as decision-making, reporting, and benchmarking.

Our primary focus, however, is on ESG software tailored for the real estate business. This includes solutions designed for clients that manage real estate, such as property, asset, and fund managers, as well as facility managers and corporations. As a result, these tools are crafted to address ESG challenges and opportunities within the real estate sector.

ESG in Real Estate

When discussing ESG in Real Estate we address how the E, S, and G criteria can measure the impact of Real Estate assets and operations on the environment. It is no surprise that buildings and the construction sector are the main source of emissions of CO2 [2]. Meaning, that real estate significantly impacts the environment, and real estate companies have a role in actively contributing to reducing this environmental impact.

As one interviewee wisely expressed: “The best building is the building not built.” He went on to explain the growing desire to minimize real estate impact from both the investor and the occupier side. On the investor's side, there is an increased awareness of how assets can negatively affect the environment, and there is a consideration of how environmental factors can impact the business of this investor. While on the consumer’s side, there is a preference for more sustainable products.

For example, as regions within a country consider adopting carbon taxes, the pressure to implement sustainable practices to comply with both local and global frameworks intensifies. Corporations, for instance, are now demanding green buildings, which not only enhances their marketing and brand image but also aligns with the increasing consumer demand for eco-friendly spaces.

From an investor's perspective, owning a building that is not sustainable is seen as a risk. The value of such properties can decline, and it becomes increasingly difficult to lease them to occupiers who now prioritize environmentally friendly buildings. As noted, “In the past, real estate was primarily about location, location, and a bit about amenities, like hospitality and services around the building. Now, the environmental ESG performance of those buildings is also taking centre stage.”

The impact of an asset

Assets impact the environment throughout their entire lifecycle, from construction to demolition. However, for this investigation, our focus is on the built environment—the operational phase of an asset's lifecycle. During this phase, assets consume resources like electricity for temperature control and lighting, as well as biofuels and gas [3]. In return, they emit pollutants such as carbon dioxide, generate waste, and contribute to environmental challenges like urban overheating and disruptions to local climate change [4].

To tackle these challenges, real estate stakeholders are implementing various strategies to reduce environmental impact. These include lowering carbon emissions, retrofitting buildings for energy efficiency, integrating smart technology, and embracing circular economy principles, among others. Collectively, these actions form part of a broader real estate optimisation strategy focused on sustainability and minimizing environmental harm.

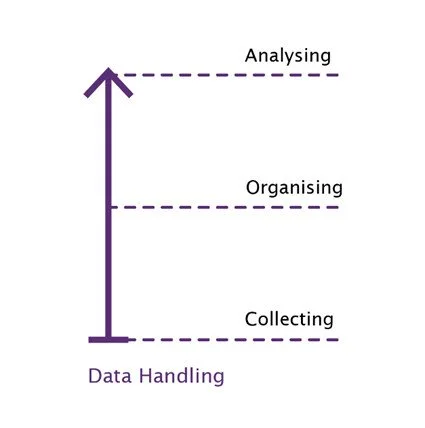

The organisational pyramid and data

Nine of the twelve solutions we have spoken to understand the different strategies real estate parties implement and are actively helping them implement these strategies. These solutions have features that assist in minimizing the environmental impact of real estate. Despite differences in functionality, whether focused on reporting, energy management, or other areas, each solution contributes to reducing an asset's impact. A key component of this effort is data handling, which involves collecting, organizing, and analysing data to generate insights and enable informed decision-making.

Figure 1: Data Handling process.

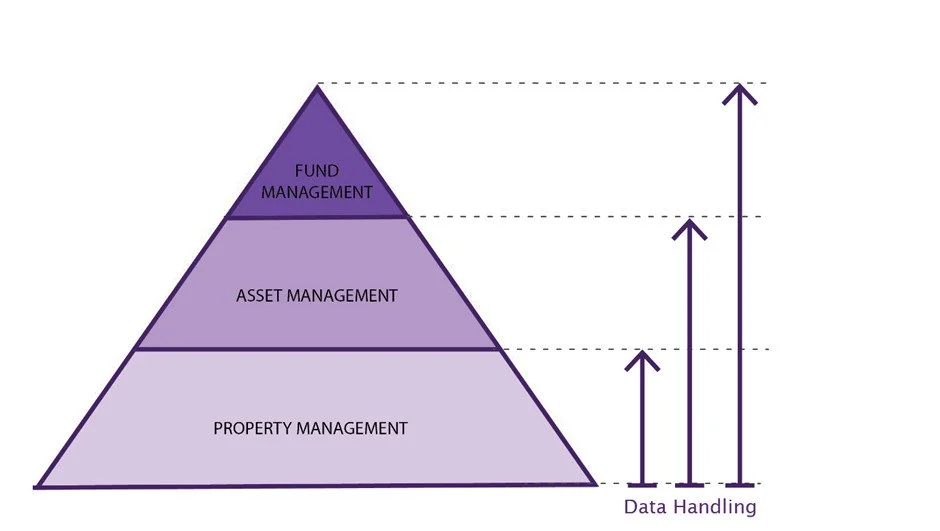

While seemingly straightforward, this process typically begins at the base of the real estate organisational pyramid, encompassing all levels within the organisation. The responsibility for collecting an asset's data primarily falls to property or facility managers at the foundational level. Once gathered, this data can be organized and analysed at various levels within the pyramid, with each solution having a distinct objective for how the data is utilized and interpreted.

Figure 2: Data handling processes occurring at each level of the Real Estate pyramid.

For instance, in a reporting system that generates reports on GRESB, data about an asset would be collected by those at the bottom of the organisational pyramid, while the analysis and report generation would likely occur at the top, by fund managers. On the other hand, in a building management system, both the data collection and analysis are often handled by the same foundational level—property or facility managers.

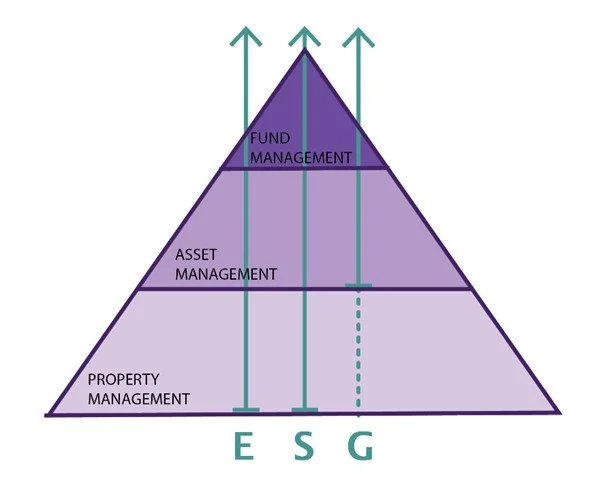

Operational and Strategic level of optimisation

Optimising an asset’s performance can reduce its environmental impact. The same holds true for efficiently managing a sustainable portfolio and implementing an ESG strategy, which can, in turn, positively influence overall business performance. Both approaches help mitigate the impact of real estate on the built environment. The first approach, occurs on the operational level of the organisation, tackling aspects that are dealt with during the operation of an asset. An example is, collecting consumption data and optimising consumption based on insights given by the solution. The second approach, on the other hand, is set at a strategic level of an organisation. Meaning, that once the collected data is analysed its results may be used to enhance and optimise a real estate portfolio.

From our observations, solutions can be actively involved in optimising real estate at the operational and strategic levels, as portrayed by four of the twelve companies interviewed. This statement is particularly true for ESG-specific solutions as they can focus on features and processes that span all the organisational levels of the real estate pyramid. On the contrary, established solutions tend to focus on specific levels of the real estate pyramid and have a clear marketing cut when presenting their features to the real estate world. In any case, a clear depiction of whether a solution tackles the operational or strategic level is always useful for real estate parties trying to understand how software can add value and align with their business.

Figure 3: ESG optimisation levels for the real estate pyramid.

Focus on E

While ESG solutions can address Environmental (E), Social (S), and Governance (G) factors, we have observed a focus on optimising the Environmental aspect. Only 25% of the solutions we interviewed actively target the Social and Governance components by providing decision-making tools for real estate organisations to improve these areas. According to the interviewees, this focus on the Environmental aspect stems from its more tangible and measurable nature. Environmental data can be collected using meters, sensors, and other hardware, whereas Social and Governance data often require more labour-intensive methods, such as surveys and questionnaires distributed within and outside the own organisation.

This challenge is compounded by the fact that Environmental and Social data typically relate to assets, while Governance data is usually tied to the company level. Since many of these solutions are built with assets in mind, collecting data that is not directly connected to a building adds another layer of complexity. This is backed by an interview that mentioned the trouble of collecting such data: “That was sort of the challenge. If we have set up the information under the assets: How do we track governance that goes above an asset? That is more on the company level.”

In this context, and based on the interviews, we have a clearer understanding of how solutions operate and how the market functions when it comes to Environmental data, but less so when it comes to Social and a bit less for Governance-related data. Zooming in on the Environmental (E) aspect, it was noted that the data collected around the E can inform decision-making on parties who deal with the operational and also strategic levels in real estate.

Additionally, Environmental (E) data can be gathered not only to optimise an asset’s consumption, as is widely recognized, but also to enhance the asset’s structural efficiency. Meaning, that solutions will use the E to create scenarios on structure optimisation to prevent assets from being stranded. As the structural change directly affects the CapEx of real estate companies, some solutions can even assist with the Green CapEx calculation.

The S and the G

When addressing the Social (S), and Governance (G) factors within the real estate organisational structure, Governance (G) is often tied to corporate structure, business ethics, and board composition6, positioning it at the strategic level. The Social (S) component, on the other hand, can influence both strategic and operational aspects of real estate. For example, Integrated Workplace Management System (IWMS) solutions focus on workspace experience, optimising factors such as occupancy, air quality, well-being, and thermal comfort. In these instances, data is collected at the property and facility management level and can be used both to enhance the asset's performance and for higher-level strategic reporting and decision-making.

To solidify our understanding of how the market approaches real estate optimisation, we will once again categorize Environmental (E), Social (S), and Governance (G) data within the strategic or operational levels of real estate, as illustrated in Figure 4. On the strategic path, solutions like asset and fund management systems, along with ESG reporting and benchmarking platforms, leverage data related to Environmental (E), Social (S), and Governance (G) factors to optimise assets, portfolios, funds, or entire businesses at a strategic level. On the operational path, solutions primarily focus on optimising the Environmental (E) aspect but also address Social (S) factors, particularly through improvements to buildings and workspaces.

Figure 4: ESG data categorized in the real estate pyramid.

Solutions Framework

In conclusion, the ESG software solution landscape for real estate is multifaceted, focusing primarily on Environmental (E) criteria, but also offering tools to address Social (S) and Governance (G) aspects. Based on our findings, we have drawn up a framework (figure 5) to better understand how these solutions function across different real estate organisational levels.

This framework builds on the concepts discussed in this article, mapping the Environmental (E), Social (S), and Governance (G) aspects across the organisational levels within real estate. These levels include property and facility managers at the foundational level, asset management in the middle, and fund management at the top. For each level, arrows illustrate the data handling process, which includes collecting, organizing, and analysing data. This indicates that E, S, and G data can move across each organisational level, generating analysis that serves different purposes depending on the responsibilities of the specific real estate player at each level. For example, a property manager might use E and S data to gain real-time insights into a building’s performance, while a fund manager could utilize the same data to make informed hold/sell decisions about a specific fund.

It was also noted that ESG features can provide solutions in both strategic and operational spheres. The framework illustrates these two distinct areas, emphasizing that features used by fund and asset managers have a strategic focus, while those utilized by property and facility managers, as well as asset managers, are more operational. Worthy to note, there is a clear overlap of the strategic and operational spheres when it comes to ESG features being used by asset managers. This overlap arises from the varied scope of their responsibilities, enabling them to use analysed data for both operational tasks, such as ensuring asset performance, and strategic tasks, such as aligning ESG initiatives with broader business goals.

Additionally, when mentioning the E aspect, ESG solutions have two distinct features that can be targeted: optimising consumption or optimising structure. These two targets are also distinguished in the framework. Since the majority of solutions, we interviewed emphasize the Environmental (E) component, our analysis of the ESG solution market for real estate will also concentrate more heavily on this element. This focus enabled us to provide a more detailed understanding of having distinct features for the E on optimising consumption and optimising structure. Unfortunately, we cannot provide the same level of clarity for the Social (S) and Governance (G) aspects.

Ultimately, ESG solutions aim to assist real estate businesses in both optimising individual assets and shaping broader business strategies. They achieve this by collecting, organizing, and analysing data to generate actionable insights that help professionals make informed decisions aligned with sustainability goals. This framework offers a clearer understanding of the current market landscape, illustrating how different solutions contribute to real estate optimisation. The focus remains on buildings, as most ESG data is derived from the building itself or from its impact on the environment and its occupants.

Further, an extra governance layer has been incorporated into the framework. This layer is not directly tied to an asset and, therefore, does not align with specific real estate organisational levels. Instead, it represents the overarching organisational structure of a real estate company, such as HR and other supporting functions, like for example CRM. Although the solutions we examined do not heavily emphasize data collection related to governance (G), this layer is essential to our framework as it is where governance-related data is gathered.

Figure 5: Framework for ESG software solutions catered to Real Estate.

Sources:

1 – Royal Institution of Chartered Surveyors (RICS), (2021). Sustainability and ESG in Commercial Property Valuation and Strategic Advice. In J. FitzLeverton (Ed.), RICS Guidance Note (3rd ed.). Royal Institution of Chartered Surveyors (RICS).

2- United Nations Environment Programme and Yale Center for Ecosystems + Architecture, Building Materials and the Climate: Constructing a New Future.

3- González-Torres, M., Pérez-Lombard, L., Coronel, J. F., Maestre, I. R., & Yan, D. (2021). A review on buildings energy information: Trends, end-uses, fuels and drivers. Energy Reports, 8, 626–637.

4- Santamouris, M., & Vasilakopoulou, K. (2021). Present and Future Energy Consumption of Buildings: Challenges and Opportunities towards Decarbonisation. e-Prime - Advances in Electrical Engineering Electronics and Energy.

5- JLL. (2021). Responsible Real Estate Ambitions, commitments and actions Decarbonizing the Built Environment.

6 - World Economic Forum Global Future Council on Transparency and Anti-Corruption. (2022). Defining the ‘G’ in ESG: Governance factors at the heart of Sustainable business.

Disclaimer: Please be aware that the information in this article is based on verbal communication with suppliers and has not been independently verified.