• Rental income shortfall from business occupiers reached £5.34 billion over the first 12-months of the pandemic

• March Quarter Day collection figures worst since June 2020

Pension funds, insurers, institutions and other investors in the property sector experienced a shortfall of £5,343,435,000 in rent collected on commercial properties over the first twelve months of the pandemic, according to the latest research published by Remit Consulting.

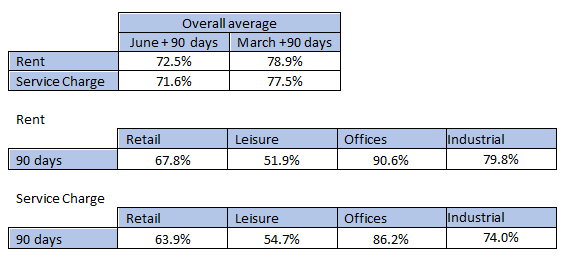

Based on verified financial reports from national firms of property managers responsible for 125,000 leases on over 31,000 prime commercial property investment properties across the country, Remit Consulting analysed rent and service charge payments for the three months between Christmas and the March Quarter day.

“Over the 90 days of the December Quarter, the shortfall experienced by investors, many of which are pension funds, insurers and other institutions totalled over £1.1 billion with 78.6% of the rents due collected overall,” said Steph Yates, a senior consultant at Remit Consulting.

“While this figure is generally in line with the previous three quarters of the pandemic, there were some concerning trends within the different sectors that we study with the rent collected on leisure properties (restaurants, pubs, etc.) falling by nearly 6% compared to the previous quarter. The same comparison for retail properties saw a fall of nearly 3%.

"The initial analysis of the data on rent collection for the March Quarter Day indicates that property managers are seeing further falls in the levels of rent paid across the board. Overall, less than half of the rent payments due on March Quarter Day were received by property managers and reveal the poorest start to a financial quarter since June last year, which were the lowest collection rates of the pandemic so far," said Laura Andrews of Remit Consulting.

"After 12 months of lockdowns and restrictions, it is possible that the ongoing uncertainty regarding the route out of the pandemic, combined with a further extension of the Government's moratorium on evicting tenants due to non-payment of rent because of Covid-19, is causing further issues with rent payments from business occupiers,” she added.

Steph Yates confirmed the concerns of property managers and many institutional asset managers regarding the uncertainty surrounding many tenants’ ability to pay their debts.

“The extension of the moratorium at the beginning of March will have pleased the hard-core of business occupiers that are choosing not to pay rent. It may also have caused other tenants to withhold their rent. While they remain in occupation without paying rent, landlords are faced with stranded assets, not knowing if the tenant is viable or not. Paraphrasing the Nobel Prize-winning physicist, we are describing them as ‘Schrödinger’s tenants’ - occupiers that are simultaneously both alive and dead,” she said.

Remit Consulting also reports the growing expectation within the property sector that, when the moratorium is lifted, the market might see an increase in the use of Company Voluntary Arrangements (CVAs) as an escape route for businesses struggling to pay their rent.

Government statistics, provided by The Insolvency Service, show that during 2020 insolvencies in the UK, including CVAs, was at their lowest since 2010. Additionally, the number of CVAs in February was just a third of those witnessed twelve months earlier.

Working in conjunction with the British Property Federation (BPF), the RICS, Revo, the Agent's Advisory Group, and other members of the Property Industry Alliance (PIA), Remit Consulting has been analysing the collection of rent and service charge payments by the country's largest property management firms since the start of lockdown.